Your credit score is a numerical representation of your creditworthiness, based on information in your credit report. It is used by lenders to evaluate your risk as a borrower and to determine whether to approve your loan application.

When applying for a personal loan, lenders typically look at your credit score to determine your creditworthiness and to set the terms and conditions of the loan. A higher credit score can increase your chances of being approved for a loan and may also result in a lower interest rate. On the other hand, a lower credit score can make it more difficult to get approved for a loan or may result in a higher interest rate.

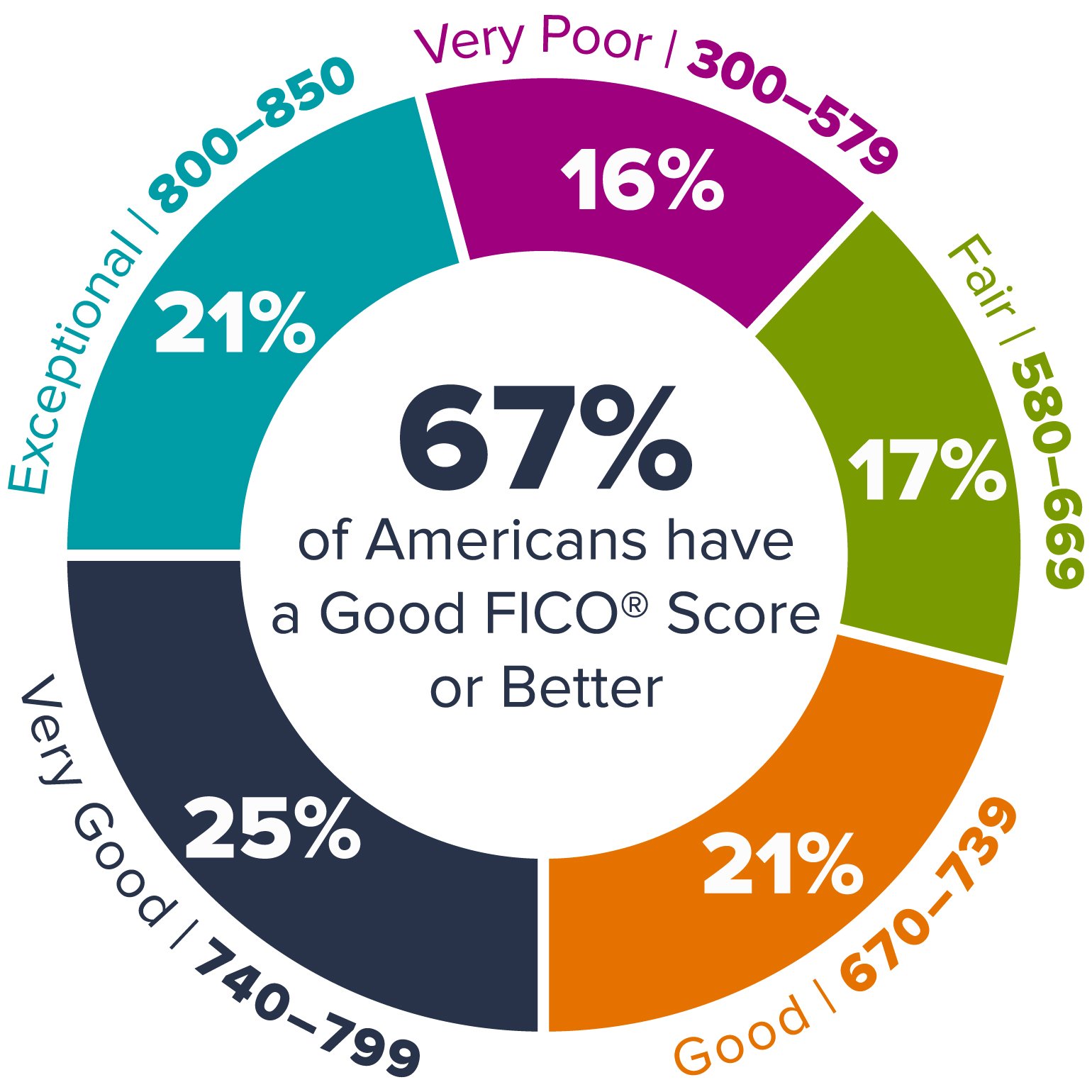

There are a few different credit score ranges that are commonly used:

- Excellent: 750 or higher

- Good: 700-749

- Fair: 650-699

- Poor: 600-649

- Bad: Below 600

To improve your credit score, it is important to pay your bills on time, keep your credit card balances low, and avoid applying for too much credit at once. It is also a good idea to check your credit report regularly to ensure that the information it contains is accurate and up-to-date. If you find any errors or discrepancies, you can dispute them with the credit bureau to have them corrected.

By maintaining a good credit score, you can increase your chances of being approved for a personal loan and getting a competitive interest rate.