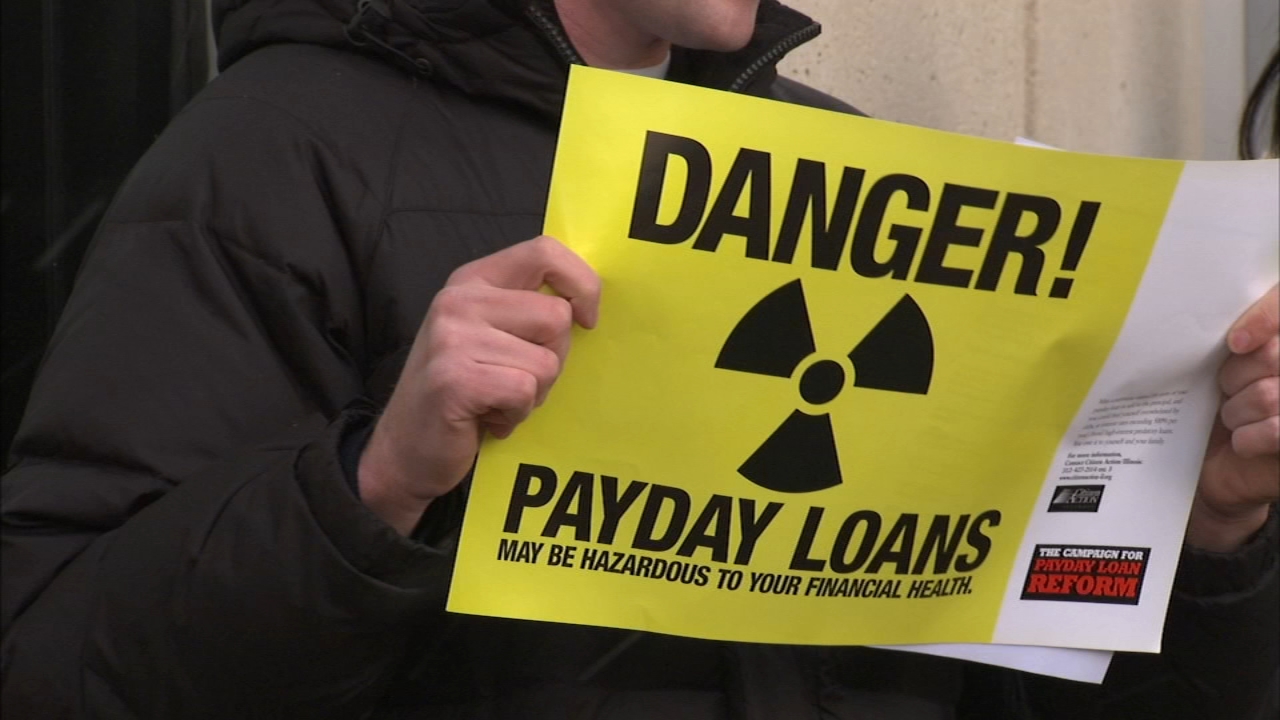

Payday loans can have a significant impact on financial health, especially if they are used frequently or lead to a cycle of debt. Here are a few ways in which payday loans can impact financial health:

- High fees and interest rates: Payday loans often have high fees and interest rates, which can make them expensive in the long run. This can put a strain on your budget and make it difficult to pay off other debts or save money for the future.

- Short repayment periods: Payday loans are typically due on your next payday, which means you have a very short repayment period. This can make it difficult to come up with the funds to pay off the loan, especially if you are already struggling financially.

- Risk of falling into a cycle of debt: If you are unable to pay off a payday loan on time, you may be tempted to take out another loan to cover the original one. This can lead to a cycle of debt that is difficult to break and can further damage your financial health.

- Negative impact on credit scores: Payday loans can have a negative impact on your credit score, especially if you default on the loan or have multiple payday loans outstanding. This can make it harder to obtain other loans or financial products in the future.

By understanding the potential risks and drawbacks of payday loans, you can make an informed decision about whether this type of loan is right for you. If you do decide to take out a payday loan, be sure to use it responsibly and make every effort to pay it off on time to minimize the negative impact on your financial health.